Unity: A contrarian investment

By TickerTango

Introduction

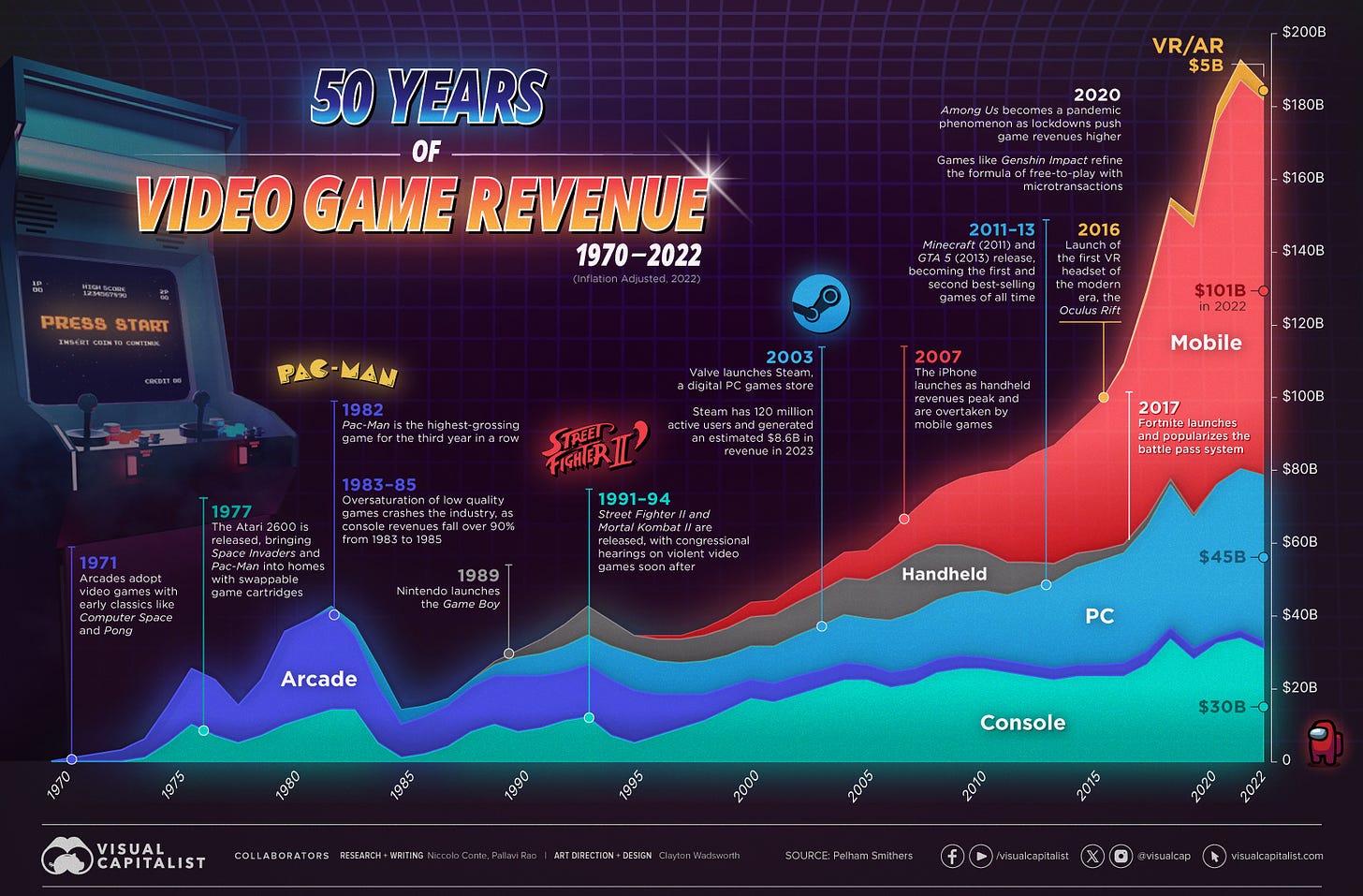

Unity Technologies revolutionized the indie gaming industry with its cross-platform gaming engine, first launched in 2005. Known for its versatility and ease of use, Unity became a popular choice among both seasoned and novice developers. Today, over 60% of the world’s mobile games are developed with Unity, including 70% of the top 1,000 games, and applications made with Unity are downloaded 3.7 billion times a month on average. Unity also holds a strong position in the console gaming market, with around 50% market share, further reinforcing its cross-platform dominance.

Source: Visual Capitalist

Unity Software went public in September 2020, a move that, to the credit of former management, was timed opportunely during a peak in tech valuations. The IPO raised $1.3 billion, providing Unity with substantial capital to fuel its growth ambitions.

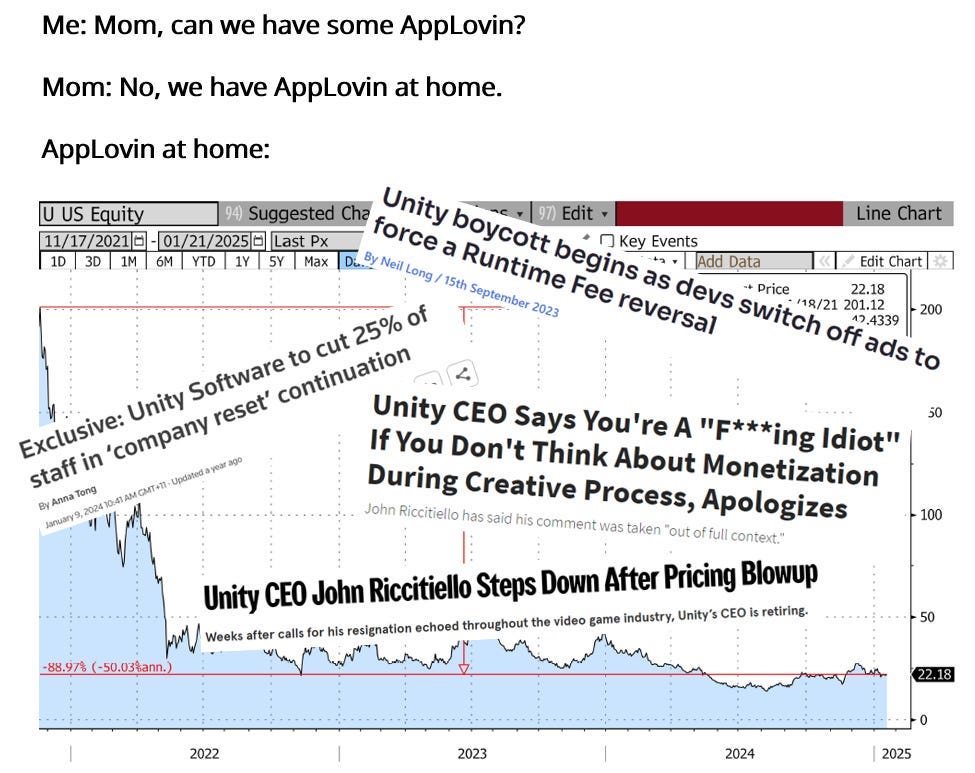

As a business, Unity has shown tremendous potential due to its dominant position in real-time 3D content creation and its complementary mobile ad network for monetization. However, the timing of the IPO also partly explains the stock’s subsequent decline, as the market corrected from the lofty valuations of 2021. Unity’s share price plummeted from an all-time high of $201 to a low of $14 over the past three years.

Source: Bristlemoon Capital

Business model & Segmentation

Unity is a leading platform for creating, operating, and monetizing real-time 3D (RT3D) content, particularly in the mobile gaming space. The company is organized into two main segments: Create Solutions and Grow Solutions.

Create Solutions includes the Unity Editor, a powerful software platform for building and deploying interactive 3D experiences. It also covers industry solutions, where Unity’s 3D capabilities are applied in non-gaming contexts, such as architecture, construction and aerospace.

Grow Solutions is Unity’s monetization arm, comprising a mobile ad network that aids user acquisition and app revenue generation. The synergy between these segments offers developers an end-to-end solution from content creation to monetization, unmatched in the industry.

Challenges & Strategic shifts

Unity faced a major setback when its previous leadership attempted to boost revenue by introducing a runtime fee that charged developers per installation. This move, intended to increase the company's take rate, sparked significant backlash from the developer community.

Source: Innersloth

Following the fallout, Unity revamped its leadership. Before appointing Matthew Bromberg (former Zynga COO) as CEO in May 2024, the company underwent a prolonged transition period under interim CEO Jim Whitehurst (former Red Hat CEO), who also became chairman. During Whitehurst’s interim tenure starting in October 2023, Unity executed several large layoff rounds, including a significant cut of 1,800 employees (25% of its workforce) in January 2024, alongside extensive restructuring efforts to streamline operations and refocus on core businesses. The new leadership team has pledged to refocus on Unity’s core strength: Supporting game developers, while improving operating efficiency and profitability. Bromberg's experience in operational efficiency and Whitehurst’s background in developer community management are seen as key to Unity’s recovery.

Competitive landscape

Unity continues to remain the gaming engine of choice for independent developers due to its advantages in ease of use, versatility, and cross-platform compatibility over gaming consoles, mobile (iOS and Android), web, desktop and AR/VR platforms. Notably, Unity has established itself as a first mover and leader in extended reality (XR), securing partnerships with both Apple and Google to support platforms like Apple’s Vision Pro headset and Google’s XR initiatives. This positions Unity at the forefront of immersive technologies.

GoDot, Unity’s leading open-source alternative, still lacks key features for advanced 3D support, as well as the community tools and support that Unity’s game developers have. The view is that Unity can continue to be the preferred choice for (indie) developers if it takes steps to win back trust and doesn’t antagonize its customers again.

Unity faces strong competition in both its gaming engine and ad management businesses. In the gaming engine space, its primary rival is Epic Games’ Unreal Engine, which excels in high-end AAA games with advanced 3D graphics and lighting, while Unity’s ease of use and hardware flexibility make it the go-to choice for indie developers and mobile games.

In mobile game ad management, Unity trails behind the dominant player, Applovin, whose ad business has seen near 100% growth compared to Unity’s stagnant performance. However, Unity’s recently launched AI-powered Unity Vector platform, a state-of-the-art neural network advertising model, could help close this gap. With its gaming engine generating vast amounts of user data, a key advantage over Applovin, Unity has the potential to emerge as a significant AI-driven player in the ad space. If Unity can leverage this data effectively and overcome the missteps of former CEO John Riccitiello, it could rival Applovin and transform into a compelling growth story, especially as investors begin to draw comparisons with Applovin’s success.

Strategic initiatives & Q1 2025 results:

The global gaming market is booming and is projected to reach $300 billion by 2026. This growth is driven by the rise of mobile gaming, the adoption of immersive technologies like AR/VR and rapid advancements in AI-powered mobile advertising. In this evolving landscape, Unity’s strategic repositioning comes at a crucial time.

The main thesis for double-digit revenue growth within Unity’s Create Solutions lies in the increase in subscription pricing. After canceling the runtime fee, Unity raised prices by 8% for pro plans (now $2,200/year) and 25% for enterprise plans. Feedback from game developers has been mostly positive, as they view the cost increase as manageable compared to the significant fees charged by mobile app stores. Unity has reported consistent double-digit subscription revenue growth over the past several quarters and this trend is expected to continue.

In its Q1 2025 earnings, Unity reported an 8% YoY revenue decline, however, this quarter's focus is less about the numbers and more about execution. I think Unity's turnaround is gaining momentum. Here’s why:

⦁ Unity Vector launch: A major milestone in Unity’s progress is the early launch of Unity Vector, the company’s AI-powered ad platform. Deployed 10-11 weeks ahead of schedule, Vector now handles all iOS and Android ad traffic. This early deployment marks a significant vote of confidence in Unity's leadership and signals a shift towards more integrated, scalable solutions. While still being fine-tuned, this early launch indicates that Unity is on track.

⦁ Revenue decline: The decline in revenue is largely due to the company’s strategic decision to exit lower-margin, non-core services, such as the sale of the Digital Twin unit to Capgemini in 2024. These services were not aligned with Unity’s long-term strategy. While the Digital Twin opportunity remains promising, Unity is focusing on building tools for its customers, rather than doing the work for them. This is a key part of their shift to more scalable, margin-friendly solutions.

⦁ Focus & Developer sentiment: Unity’s strategic focus is now much clearer: Building the best engine and supporting developers with the complete features they need. The company is no longer trying to be everything to everyone but is instead streamlining its operations. Developer sentiment has significantly improved, with 43% of active users already on Unity 6, and over 80% planning to upgrade. This marks a substantial reversal from the negative fallout caused by the runtime fee decision under previous leadership, which hurt developer trust.

⦁ Operational efficiency: Unity has achieved notable improvements in operational efficiency, capitalizing on its 80% adjusted gross margin to deliver significant operating leverage. As the ad business scales, the company anticipates enhanced EBITDA margins while exercising disciplined management of headcount, stock-based compensation and software spending. The new CFO, Jarrod Yahes, has proven to be a substantial upgrade over his predecessor. During his first earnings call as CFO, an analyst playfully challenged him, saying, “I have to throw you under the bus in your first earnings call as CFO and ask about margins.” Yahes responded with confidence: “Unity is a business with an 80% adjusted gross margin and plenty of levers to drive further expansion.” This operational strength, paired with a low valuation, underscores Unity’s potential as a high-growth investment.

Leveraging monetization trends & Vector’s potential

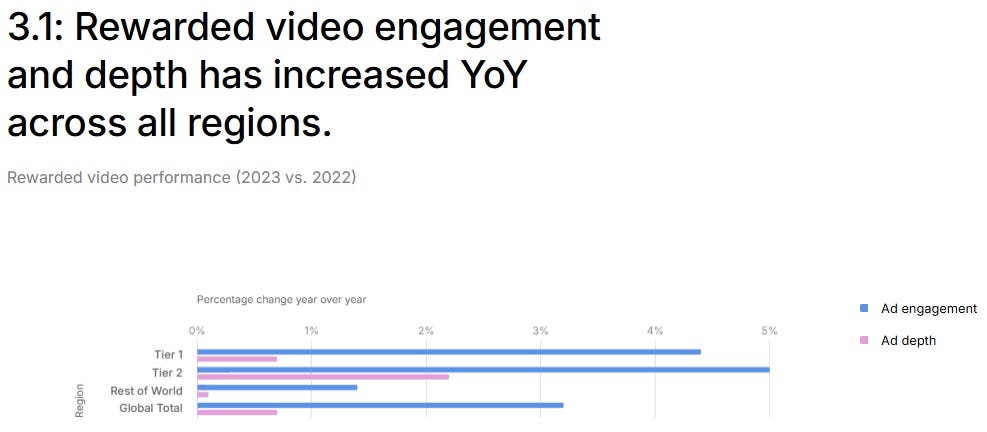

The 2024 Mobile Growth and Monetization report from Unity supports its strategic direction, particularly with the early launch of the AI-powered Unity Vector platform. Global ad engagement increased 3.2% year-over-year, with even higher growth in high-purchasing-power regions like Tier 1 and Tier 2 markets.

Source: https://unity.com/resources/mobile-growth-monetization-report-2024

This trend highlights the growing importance of in-app advertising (IAA) for monetization, especially as macroeconomic pressures lead more users to engage with ads instead of spending on in-app purchases (IAPs). Vector is well-positioned to capitalize on this by optimizing campaigns to target high-value users, as shown by its ~50% increase in installs for ZephyrMobile on iOS.

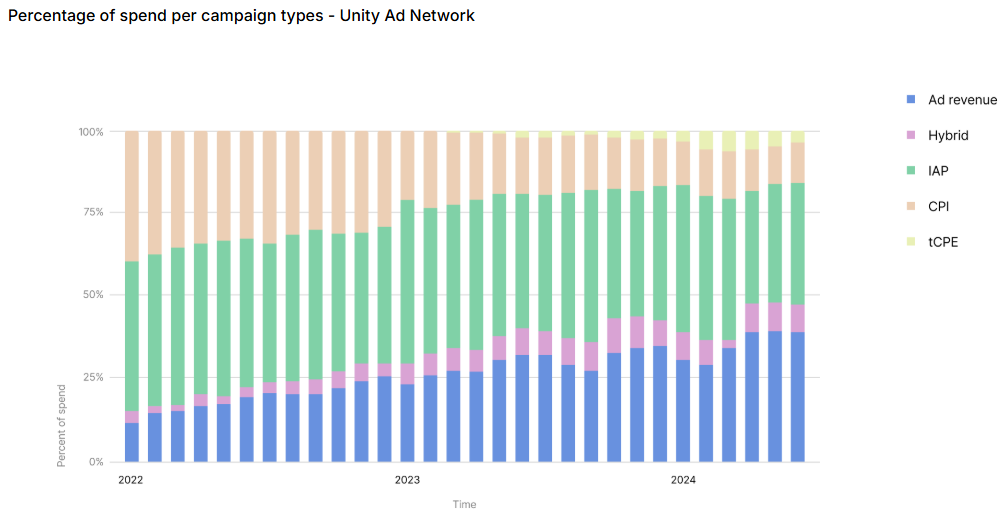

Advertisers are also diversifying user acquisition (UA) strategies, shifting toward hybrid ROAS (Return On Ad Spend) campaigns that optimize for both IAA and IAPs. This aligns with the chart provided in the report, which showed a significant rise in IAP-focused campaign spend on the Unity Ad Network from 2022 to 2024.

Source: https://unity.com/resources/mobile-growth-monetization-report-2024

Unity Vector’s ability to leverage Unity’s vast user data gives it a clear edge over competitors like AppLovin when it comes to optimizing ads and targeting high-value users. AppLovin is well aware of this data advantage, it's exactly why they attempted to acquire Unity back in 2022. While that deal didn’t go through, it highlighted how valuable Unity’s data and developer relationships are in the mobile ad space.

One of the most promising components of Unity’s advertising strategy is its Offerwall, a user-initiated ad format that allows players to earn in-game rewards by completing tasks such as downloading an app, signing up for a service, or watching a video ad. Unlike traditional ad formats, Offerwall is opt-in and highly engaging, making it especially effective at monetizing non-paying users. Offerwall users demonstrate 2–7x higher retention and 100% higher lifetime value on D7 (a common metric in mobile gaming and app analytics, it represents the seventh day after a user installs an app or game) compared to other ad formats. This suggests that Unity’s focus on scalable, engagement-driven ad solutions can further strengthen its Grow Solutions segment, especially when paired with the targeting precision of Unity Vector.

Bear thesis:

What would an investment case be without a bear thesis? Despite Unity’s promising turnaround narrative, several risks could impede its recovery and long-term growth, presenting a bearish case for the stock.

First, Unity remains unprofitable, with negative EPS and continued revenue declines, as evidenced by the 8% YoY drop in Q1 2025. This raises concerns about the company’s ability to achieve sustainable profitability, especially in a competitive market where AppLovin is consistently outpacing Unity in mobile ad growth.

Second, execution risks remain significant with the rollout of Unity Vector. While the early launch is a positive signal, the platform’s fine-tuning phase could introduce delays or underperformance, which may hinder Unity’s ability to close the gap with AppLovin as expected.

Third, Unity’s heavy reliance on indie developers, while a strength, also poses a risk. These smaller teams may resist subscription price increases or migrate to free alternatives like GoDot if Unity fails to maintain developer trust and satisfaction.

Finally, macroeconomic headwinds such as high interest rates and a potential slowdown in consumer spending on gaming due to political uncertainty could further pressure Unity’s ad revenue and growth prospects. Given Unity’s exposure to the cyclical mobile gaming market, these factors could significantly impact its ability to achieve long-term growth.

Conclusion:

Under the leadership of CEO Matthew Bromberg and CFO Jarrod Yahes, Unity Software is navigating a compelling turnaround from the challenges left by former CEO John Riccitiello, positioning it as a contrarian investment with significant upside potential. Unity’s valuation is notably attractive, with a P/S ratio of 4.62, well below the peer average of 13.05 for CAD and related high-margin software companies like Autodesk (P/S 9.23), Cadence Design Systems (P/S 17.50), and Synopsys (P/S 12.41). While these peers operate in different verticals, the comparison underscores how undervalued Unity appears relative to similarly scaled, IP-driven software businesses.

The new management’s focus on operational efficiencies and Unity’s exposure to high-growth markets signal strong potential for multiple expansion. Although Unity is not a traditional CAD tool, it shares key characteristics with those businesses, including high margins with sticky, recurring revenues and pricing power, which typically justify premium valuation multiples.

Since Matthew Bromberg took over as CEO in Q2 2024, visible results have already emerged. Free cash flow has grown from $439 million to $727 million, profit margins have increased from 4.54% to 9.53%, operating margins have risen from 4.61% to 10.84%, and EBITDA has grown from $1,038 million to $1,548 million. Additionally, outstanding shares have remained flat for the first time in years, indicating strong operational discipline.

If Unity achieves profitability and sustains growth, it could transition from an “ugly duckling” to a quality-growth asset, potentially becoming a multibagger. For context, if Unity were to increase its take rate in the $100+ billion mobile gaming industry from its current 0.4% to a modest 1%, a level still below industry expectations for mission-critical tools, it could unlock an additional $600 million in annual revenue. However, risks around execution and competition persist. Investors focusing on Unity’s long-term potential, rather than quarterly fluctuations, may find its current valuation an attractive entry point with the potential for significant returns.

Disclaimer: The information presented herein is for informational purposes only and does not constitute financial advice.

If you enjoy updates and write-ups about tech stocks like this one, feel free to follow me on Twitter: TickerTango

Interesting company, thanks for the write up!